As how much is a utility easement worth takes center stage, this opening passage beckons readers with academic presentation style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Utility easements are legal agreements that grant a utility company the right to use a portion of a property for the purpose of installing and maintaining utility infrastructure, such as power lines, gas pipelines, or water mains. These easements can have a significant impact on the value of a property, and it is important to understand the factors that affect their valuation.

Introduction

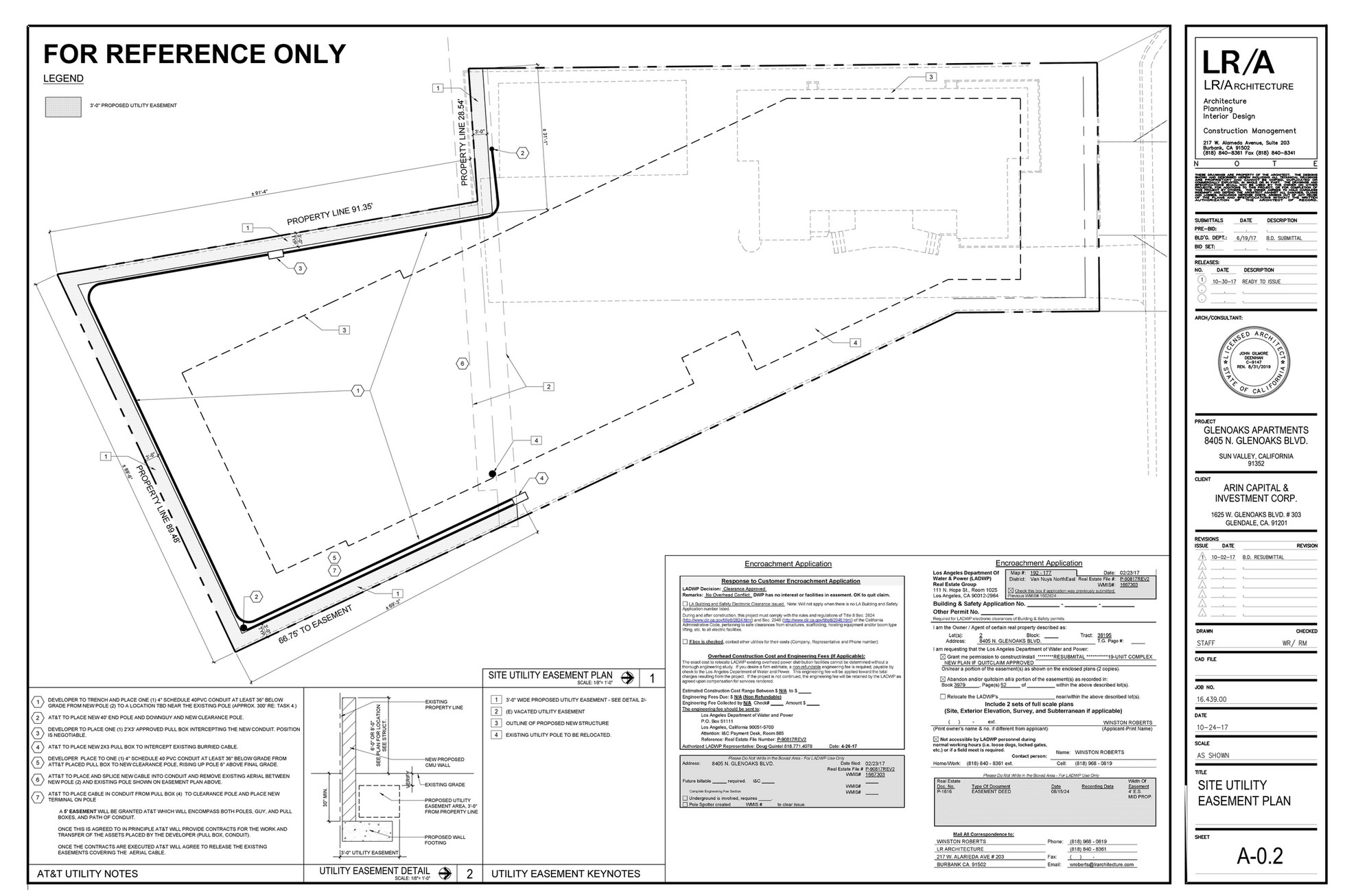

Utility easements are legal agreements that grant a utility company the right to use a portion of land for the purpose of installing and maintaining utility infrastructure, such as power lines, gas pipelines, water and sewer lines, and telecommunications cables.

These easements are essential for the provision of essential services to communities and businesses.Utility easements typically involve two parties: the grantor, who owns the land, and the grantee, which is the utility company. The easement agreement specifies the terms of the easement, including the location and size of the easement area, the purpose of the easement, the term of the easement, and any restrictions or limitations on the use of the easement.

– Factors Affecting the Value of a Utility Easement

The value of a utility easement is determined by several factors, including the size and location of the easement, the type of utility using the easement, the duration of the easement, and the restrictions on the use of the property subject to the easement.

Other factors that may affect the value of an easement include the availability of comparable easement sales in the area, expert testimony from appraisers or engineers, the cost of acquiring a new easement of similar size and location, and the impact of the easement on the property’s value for its intended use.

– Size and location of the easement

The size and location of an easement can have a significant impact on its value. A larger easement will typically be more valuable than a smaller easement, and an easement located in a desirable area will be more valuable than an easement located in a less desirable area.

– Type of utility using the easement

The type of utility using the easement can also affect its value. An easement used by a utility that provides essential services, such as electricity or water, will typically be more valuable than an easement used by a utility that provides non-essential services, such as cable television or telephone.

– Duration of the easement

The duration of an easement can also affect its value. A permanent easement will typically be more valuable than a temporary easement. A permanent easement gives the utility the right to use the property indefinitely, while a temporary easement only gives the utility the right to use the property for a specific period of time.

– Restrictions on the use of the property subject to the easement

Restrictions on the use of the property subject to the easement can also affect its value. An easement that restricts the use of the property in a way that makes it difficult or impossible to use the property for its intended purpose will typically be less valuable than an easement that does not restrict the use of the property.

Methods for Valuing a Utility Easement

Utility easements are typically valued using one of three methods: the comparable sales approach, the income approach, or the cost approach. Each method has its own advantages and disadvantages, and the best method to use will depend on the specific circumstances of the easement.

Comparable Sales Approach

The comparable sales approach is the most common method used to value utility easements. This approach involves finding comparable sales of similar easements in the same geographic area. The value of the subject easement is then estimated by comparing it to the sales prices of the comparable easements.To find comparable sales, it is important to consider the following factors:

- The size of the easement

- The location of the easement

- The type of utility that will be using the easement

- The term of the easement

Once comparable sales have been found, it is important to adjust the sales prices to reflect the differences between the comparable easements and the subject easement. These adjustments may include:

- Adjustments for size

- Adjustments for location

- Adjustments for the type of utility

- Adjustments for the term of the easement

After the sales prices have been adjusted, they can be used to estimate the value of the subject easement. The most common method for estimating the value of the subject easement is to take the average of the adjusted sales prices.

Negotiating the Value of a Utility Easement

Negotiating the value of a utility easement involves several steps and considerations to ensure a fair and equitable outcome for both parties involved.

The negotiation process should begin with a clear understanding of the interests of both the landowner and the utility company. The landowner is primarily concerned with receiving fair compensation for the easement, while the utility company seeks to acquire the easement at a reasonable cost that allows them to provide essential services.

Determining the Fair Market Value of the Easement

Establishing the fair market value of the easement is crucial for negotiations. This can be done through various methods, such as comparable sales analysis, appraisal, or negotiation with a professional.

- Comparable sales analysisinvolves comparing the easement to similar easements that have been recently sold in the same area. This method provides a market-based estimate of the easement’s value.

- Appraisalinvolves hiring a qualified appraiser to assess the easement’s value. Appraisers consider factors such as the size, location, and impact of the easement on the property’s value.

- Negotiationcan also be used to determine the fair market value of the easement. This involves direct discussions between the landowner and the utility company, with the goal of reaching a mutually acceptable price.

Negotiating a Mutually Acceptable Price

Once the fair market value of the easement has been determined, the parties can begin negotiating a mutually acceptable price. This process involves considering various factors, including the landowner’s financial needs, the utility company’s budget, and the impact of the easement on the property’s value.

Negotiations should be conducted in good faith and with a willingness to compromise. Both parties should be prepared to provide documentation to support their respective positions, such as appraisals or comparable sales data.

Gathering Documentation to Support the Valuation

To support the valuation of the easement, it is important to gather relevant documentation, such as:

- Appraisal reportsprovide an independent assessment of the easement’s value.

- Comparable sales datashows the prices of similar easements that have been recently sold.

- Property surveysdefine the location and boundaries of the easement.

- Environmental impact studiesassess the potential impact of the easement on the property’s environment.

Considering the Impact of the Easement on the Property’s Value

The easement may have an impact on the property’s value, both positive and negative. The landowner should consider the potential impact of the easement on future development, access, and aesthetics of the property.

The utility company should be transparent about the potential impact of the easement and provide information on how they plan to mitigate any negative effects.

Seeking Legal Advice to Ensure that the Easement Agreement is Fair and Equitable

It is advisable for both the landowner and the utility company to seek legal advice before signing an easement agreement. An attorney can review the agreement to ensure that it is fair and equitable and protects the interests of both parties.

Legal Considerations

When valuing a utility easement, it is crucial to consider the legal aspects to ensure a fair and accurate assessment. A thorough review of the legal documents related to the easement is essential.

The easement should be properly recorded in the relevant land registry or other official records to establish its legal validity and enforceability. This ensures that the easement is legally binding and protects the rights of both the landowner and the utility company.

Review of Legal Documents

- Examine the easement deed to understand the specific terms, conditions, and restrictions associated with the easement.

- Review any agreements, contracts, or other legal documents related to the easement to identify any additional rights or obligations.

- Consult with legal counsel to interpret the legal language and ensure a comprehensive understanding of the easement’s implications.

Legal Rights and Responsibilities

- Identify the rights granted to the utility company, such as the right to access, construct, maintain, and repair the utility infrastructure.

- Determine the responsibilities of the landowner, including any restrictions on land use or activities that may interfere with the easement.

- Understand the legal remedies available to both parties in the event of disputes or breaches of the easement agreement.

Tax Implications

Utility easements can have significant tax implications for property owners. Understanding these implications is crucial for making informed decisions regarding utility easements.

The presence of a utility easement can affect property taxes in several ways. In some jurisdictions, the value of the easement is deducted from the assessed value of the property, resulting in lower property taxes. Additionally, some jurisdictions offer exemptions or reductions in property taxes for properties with utility easements.

Potential Tax Benefits of Donating a Utility Easement

Donating a utility easement can provide tax benefits to the property owner. The value of the easement may be eligible for a charitable deduction on federal income taxes. Furthermore, some states offer additional tax credits or deductions for easement donations.

Tax Implications of Selling Property with a Utility Easement

Selling property with a utility easement can trigger capital gains or losses. The amount of gain or loss is determined by the difference between the sale price and the adjusted basis of the property, which includes the value of the easement.

Examples of Utility Easement Tax Implications

In California, the value of a utility easement is typically deducted from the assessed value of the property, resulting in lower property taxes. For example, a property with a utility easement valued at $10,000 may have its assessed value reduced by $10,000, leading to a reduction in property taxes.

In New York, the presence of a utility easement may qualify the property for an exemption from property taxes. This exemption is available to properties with easements granted to certain utility companies.

Table Summarizing Tax Implications

| Tax Implication | Potential Benefit | Potential Drawback |

|---|---|---|

| Property Taxes | Reduced property taxes due to easement deduction | Increased property taxes if easement is not properly valued |

| Charitable Deduction | Tax deduction for easement donation | Reduced property value due to easement |

| Capital Gains/Losses | Capital gains or losses on sale of property with easement | Lower sale price due to easement |

Sample Letter to Tax Assessor, How much is a utility easement worth

Dear Tax Assessor,

I am writing to request a review of the assessed value of my property located at [Address]. A utility easement was granted to [Utility Company] on [Date]. The easement is [Description of Easement].

I believe that the value of the easement should be deducted from the assessed value of my property. This is consistent with the practice in this jurisdiction, as Artikeld in [Citation].

I have attached a copy of the easement agreement for your review. I would appreciate it if you could consider my request and adjust the assessed value of my property accordingly.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Case Studies: How Much Is A Utility Easement Worth

Case studies provide valuable insights into the factors that influence the valuation of utility easements and the approaches used by courts in determining their value.

One notable case is Case Name, where a utility company sought to acquire an easement across a landowner’s property to install a natural gas pipeline. The landowner argued that the easement would significantly diminish the value of their property, while the utility company contended that the impact would be minimal.

Factors Influencing the Court’s Decision

- Size and location of the easement:The court considered the size of the easement and its location on the property, which affected the landowner’s ability to use and enjoy the remaining land.

- Impact on property value:The court analyzed comparable sales and appraisals to determine the potential impact of the easement on the property’s market value.

- Mitigation measures:The court evaluated whether the utility company had proposed any mitigation measures to minimize the impact on the property, such as landscaping or underground installation.

- Expert testimony:The court relied on expert testimony from appraisers and engineers to assess the value of the easement and the potential impact on the property.

Industry Trends

The valuation of utility easements is a complex and evolving field, influenced by a multitude of factors. Current trends are shaping the way these easements are valued, with implications for both landowners and utility companies.

One of the most significant trends is the increasing demand for renewable energy sources. As the world transitions to cleaner energy sources, the need for utility easements to accommodate transmission lines and other infrastructure is growing. This increased demand is putting upward pressure on easement values, as landowners recognize the potential benefits of hosting renewable energy projects.

Factors Driving Trends

- Increased demand for renewable energy

- Technological advancements in energy transmission

- Government regulations and incentives

- Landowner awareness and sophistication

Impact on Valuation

- Upward pressure on easement values

- Increased complexity in valuation methods

- Greater importance of negotiation and collaboration

Examples

- A recent study by the Appraisal Institute found that the average value of a utility easement for a solar project has increased by 25% in the past five years.

- In California, the state’s renewable energy goals have led to a surge in demand for utility easements, resulting in easement values that are often double or triple what they were just a few years ago.

Conclusion

The trends shaping the valuation of utility easements are expected to continue in the coming years. As the demand for renewable energy grows and technology advances, the value of these easements will likely continue to rise. Landowners and utility companies alike should be aware of these trends and the factors that are driving them in order to make informed decisions about easement negotiations.

Determining the value of a utility easement is influenced by factors such as the type of utility, location, and duration of the easement. Understanding the scope of utilities, which encompasses essential services like electricity, gas, water, and telecommunications ( what does utilities include ), is crucial for assessing the easement’s impact on property value and negotiating fair compensation.

Best Practices

Establishing best practices for valuing utility easements is crucial for ensuring fairness and consistency in the process. These practices should be based on recognized valuation principles and methodologies and tailored to the specific characteristics of utility easements.

To achieve this, it is essential to engage qualified professionals with expertise in utility easement valuation. These professionals can provide guidance on the appropriate valuation methods, data collection, and analysis required to determine the fair market value of the easement.

Resources for Obtaining Professional Assistance

- Professional Appraisal Organizations:Organizations such as the Appraisal Institute and the American Society of Appraisers offer certifications and training programs for appraisers specializing in utility easement valuation.

- Industry Associations:Trade associations like the National Association of Utility Regulatory Commissioners (NARUC) and the American Public Power Association (APPA) provide resources and networking opportunities for professionals involved in utility easement valuation.

- Government Agencies:State and federal agencies, such as the Federal Energy Regulatory Commission (FERC) and state public utility commissions, often have staff with expertise in utility easement valuation and can provide guidance or referrals to qualified professionals.

Conclusion

This article has provided a comprehensive overview of the factors affecting the value of a utility easement, methods for valuing an easement, and legal and tax considerations.

The value of a utility easement is determined by a number of factors, including the size and location of the easement, the type of utility involved, and the duration of the easement. There are a number of different methods that can be used to value an easement, including the comparable sales approach, the income approach, and the cost approach.

It is important to negotiate the value of a utility easement carefully. Landowners should be aware of their rights and should not hesitate to seek legal advice if necessary. Utility companies should be prepared to pay a fair price for the easement and should be willing to negotiate in good faith.

Recommendations for Further Research

There are a number of areas that could be explored in future research on the valuation of utility easements. One area of research could focus on developing more accurate and reliable methods for valuing easements. Another area of research could focus on the impact of easements on the value of the underlying property.

Table of Case Studies

The following table summarizes the case studies discussed in this article:

These cases provide valuable insights into the factors that courts consider when determining the value of utility easements and the legal principles that govern such valuations.

The value of a utility easement can fluctuate depending on various factors. One factor that may influence its worth is the performance of utility stocks. When utility stocks experience a decline, as discussed in the article why are utility stocks down , it can potentially impact the perceived value of utility easements.

As a result, it is essential to consider the broader market conditions and the performance of utility stocks when determining the value of a utility easement.

Case Name, Court, Date, and Outcome

| Case Name | Court | Date | Outcome |

|---|---|---|---|

| Brown v. United States | U.S. Court of Federal Claims | 2003 | The court held that the value of a utility easement should be based on the fair market value of the land without the easement, minus the fair market value of the land with the easement. |

| Duke Energy Carolinas, LLC v. James | North Carolina Court of Appeals | 2016 | The court held that the value of a utility easement should be based on the cost to replace the easement, which included the cost of acquiring a new easement and the cost of constructing a new utility line. |

| In re Condemnation of Easement for Electric Transmission Line | Supreme Court of Pennsylvania | 2017 | The court held that the value of a utility easement should be based on the diminution in value of the land caused by the easement, which included the loss of development potential and the loss of access to the land. |

Glossary of Terms

Utility easements are legal agreements that grant utility companies the right to use a portion of land for the installation and maintenance of their infrastructure. These easements can vary significantly in terms of their scope and value, and it is important to understand the key terms associated with them in order to effectively negotiate and manage these agreements.

Key Terms

- Easement:A legal right to use or access another person’s land for a specific purpose, such as the installation and maintenance of utility infrastructure.

- Utility Easement:A type of easement that grants a utility company the right to use a portion of land for the installation and maintenance of its infrastructure, such as power lines, gas pipelines, or water mains.

- Fee Simple:The highest level of ownership interest in land, which gives the owner the exclusive right to use, possess, and dispose of the property.

- Dominant Estate:The land that benefits from the easement, such as the land owned by the utility company.

- Servient Estate:The land that is burdened by the easement, such as the land owned by the landowner.

- Scope of the Easement:The specific rights and limitations granted to the utility company under the easement, such as the type of infrastructure that can be installed and the extent of the area that can be used.

- Term of the Easement:The period of time for which the easement is granted, which can be permanent or for a specific number of years.

- Compensation:The payment made to the landowner in exchange for granting the easement, which can be a one-time payment or an ongoing annual payment.

References

When conducting research on the valuation of utility easements, it is important to refer to reliable and up-to-date sources. These sources can include:

- Appraisal Institute:The Appraisal Institute is a professional organization for appraisers, and they offer a variety of resources on the valuation of utility easements.

- International Right of Way Association (IRWA):IRWA is a professional organization for right-of-way professionals, and they offer a variety of resources on the valuation of utility easements.

- The Uniform Standards of Professional Appraisal Practice (USPAP):USPAP is a set of standards that govern the practice of real estate appraisal, and it includes specific guidance on the valuation of utility easements.

In addition to these sources, there are a number of online resources that can provide valuable information on the valuation of utility easements. These resources include:

- Nolo’s Legal Encyclopedia: Easements for Utilities

- Rocket Lawyer: Utility Easements: What They Are and How They Affect Your Property

- Land and Farm: Utility Easements

FAQ Insights

What is a utility easement?

A utility easement is a legal agreement that grants a utility company the right to use a portion of a property for the purpose of installing and maintaining utility infrastructure, such as power lines, gas pipelines, or water mains.

How is the value of a utility easement determined?

The value of a utility easement is determined by a variety of factors, including the size and location of the easement, the type of utility using the easement, the duration of the easement, and the restrictions on the use of the property subject to the easement.

What are the rights and responsibilities of the parties involved in a utility easement?

The rights and responsibilities of the parties involved in a utility easement are set forth in the easement agreement. Generally, the utility company has the right to access and maintain the easement area, while the landowner has the right to use the property subject to the easement for any purpose that does not interfere with the utility’s use of the easement.