Is utilities included in rent – Determining whether utilities are included in rent is a common concern for both landlords and tenants. This comprehensive guide delves into the complexities of this issue, providing clear explanations, legal insights, and practical tips to navigate the responsibilities and expectations surrounding utility payments.

Landlords and tenants have distinct roles in managing utilities. Landlords are generally responsible for providing and maintaining utility systems, while tenants are typically responsible for paying utility bills. However, there are exceptions and variations to these general rules, which we will explore in detail.

Tenant Responsibilities

Tenants are generally responsible for paying for utilities associated with their rental unit, unless otherwise specified in the lease agreement. These utilities may include electricity, gas, water, sewage, and trash removal.

Legal Obligations and Regulations

In some jurisdictions, there may be legal obligations or regulations regarding tenant responsibility for utilities. For example, some states have laws that require landlords to provide certain essential utilities, such as water and heat, to their tenants. It is important for tenants to be aware of any such laws and regulations in their area.

Common Practices and Expectations

Common practices and expectations for utility payments in different rental agreements can vary. In some cases, the landlord may include the cost of utilities in the rent payment. In other cases, the tenant may be responsible for paying for utilities directly to the utility company.

It is important for tenants to carefully review their lease agreement to determine who is responsible for paying for utilities and how payments should be made.

– Explain the landlord’s role in providing or including utilities in rent, including a breakdown of different types of utilities (e.g., water, electricity, gas).

Landlords have a significant role in providing or including utilities in rent. Utilities are essential services that tenants rely on for daily living, and landlords are responsible for ensuring that these services are available and functioning properly.

Inquiring whether utilities are included in rent is a practical consideration for renters. It’s worth noting that the concept of diminishing marginal utility, as explained in this article , suggests that the additional satisfaction derived from consuming successive units of a good or service decreases as consumption increases.

This principle can be applied to the value of utilities in a rental property, as the incremental benefit of each additional utility may diminish as more utilities are included in the rent.

Different types of utilities include:

- Water

- Electricity

- Gas

- Sewer

- Trash removal

The landlord’s responsibility for utilities can vary depending on the terms of the lease agreement and the local laws. In some cases, landlords may be required to include all utilities in the rent, while in other cases, tenants may be responsible for paying for some or all of the utilities.

Types of Utilities

Utilities are essential services that provide comfort and convenience in residential properties. The inclusion of utilities in rent can vary depending on the landlord’s policies, the type of property, and local regulations. Here are some common types of utilities that may be included in rent:

Water

- Description:Essential for drinking, cooking, bathing, and sanitation.

- Usage:Consumed for various household activities, including showering, washing dishes, and watering lawns.

Electricity

- Description:Powers electrical appliances, lighting, and heating/cooling systems.

- Usage:Consumed by devices such as refrigerators, stoves, air conditioners, and televisions.

Gas

- Description:Used for cooking, heating water, and in some cases, space heating.

- Usage:Consumed by appliances like stoves, ovens, and gas fireplaces.

Trash Removal

- Description:Removal of household waste and recyclables.

- Usage:Essential for maintaining cleanliness and hygiene.

Sewer

- Description:Removal of wastewater from the property.

- Usage:Disposes of wastewater from toilets, sinks, and showers.

Factors Affecting Inclusion of Utilities in Rent

The inclusion of specific utilities in rent can be influenced by several factors:

- Type of Property:Single-family homes or apartments may have different utility arrangements.

- Local Regulations:Some municipalities may require landlords to include certain utilities in rent.

- Landlord’s Preferences:Landlords may choose to include or exclude utilities based on their policies and financial considerations.

- Negotiation:Tenants and landlords can negotiate the inclusion or exclusion of utilities in the lease agreement.

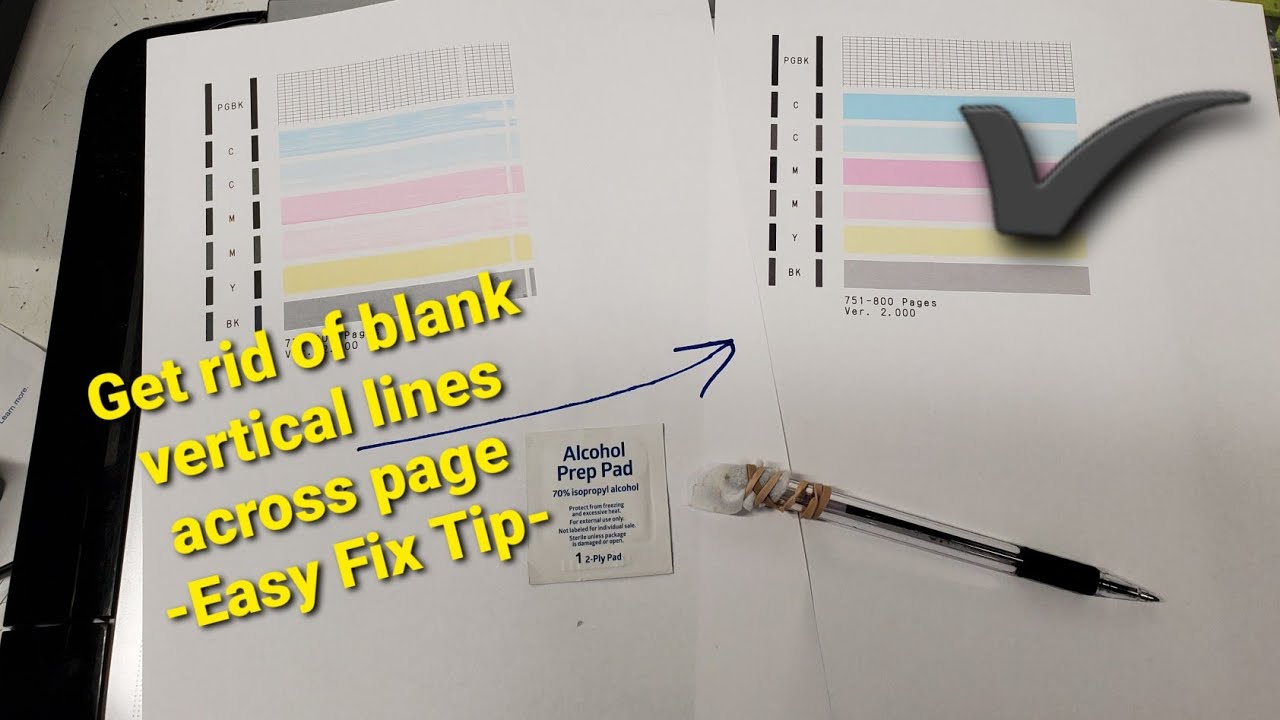

– Analyze the language used in rental agreements to specify the inclusion or exclusion of utilities.

Rental agreements often include clauses that specify whether utilities are included in the rent or are the responsibility of the tenant. The language used in these clauses can vary, and it is important to understand the legal implications of different phrasing and clauses related to utility payments.

Common Phrases Used to Specify Utility Inclusion

Some common phrases used in rental agreements to specify that utilities are included in the rent include:

- “Utilities included” or “All utilities included”

- “Rent includes utilities” or “Utilities are included in the rent”

- “Landlord pays for utilities”

Common Phrases Used to Specify Utility Exclusion

Some common phrases used in rental agreements to specify that utilities are not included in the rent and are the responsibility of the tenant include:

- “Utilities not included” or “Tenant pays for utilities”

- “Rent does not include utilities” or “Utilities are not included in the rent”

- “Tenant responsible for utilities”

– the potential benefits and drawbacks of negotiated utility arrangements for both landlords and tenants.

Negotiated utility arrangements can offer both benefits and drawbacks for both landlords and tenants. For landlords, negotiated utility arrangements can provide the opportunity to increase rental income by passing on the cost of utilities to tenants. Additionally, negotiated utility arrangements can reduce the landlord’s risk of liability for utility-related issues, such as outages or repairs.

For tenants, negotiated utility arrangements can provide the opportunity to save money on utility costs by negotiating a lower rate with the landlord. Additionally, negotiated utility arrangements can provide tenants with more control over their utility usage and costs.

Drawbacks

However, there are also some potential drawbacks to negotiated utility arrangements for both landlords and tenants. For landlords, negotiated utility arrangements can lead to increased administrative costs, such as the cost of tracking and billing tenants for utilities. Additionally, negotiated utility arrangements can create disputes between landlords and tenants over the allocation of utility costs.

For tenants, negotiated utility arrangements can lead to higher utility costs if the landlord does not negotiate a favorable rate with the utility company. Additionally, negotiated utility arrangements can limit the tenant’s ability to choose their own utility provider.

Submetering and Allocation

Submetering and allocation systems are used to divide utility costs among multiple tenants in a multi-tenant property. Submetering involves installing individual meters for each tenant’s unit, while allocation involves using a formula to divide the total utility costs based on factors such as square footage or number of occupants.

Advantages of Submetering and Allocation

* Fairness:Tenants only pay for the utilities they consume.

Conservation

Tenants are incentivized to conserve energy and water.

Cost savings

Landlords can reduce their utility costs by passing them on to tenants.

Disadvantages of Submetering and Allocation

* Installation and maintenance costs:Submetering can be expensive to install and maintain.

Potential for disputes

Tenants may dispute the accuracy of submeters or the fairness of allocation formulas.

Complexity

Submetering and allocation systems can be complex to implement and manage.

Legal Considerations

* Landlords must disclose any submetering or allocation systems in the lease agreement.

- Submetering and allocation systems must be implemented in a fair and equitable manner.

- Tenants have the right to challenge the accuracy of submeters or the fairness of allocation formulas.

Best Practices

* Use accurate and reliable submeters.

Tenants who pay rent that includes utilities may not receive individual utility bills, making it difficult to track their usage. However, it is still important to keep records of utility payments, such as rent receipts or bank statements, as they can provide proof of payment in case of disputes.

For those who receive separate utility bills, how long they should keep these bills depends on various factors, including the statute of limitations for utility debt in their jurisdiction and the terms of their lease. Ultimately, keeping utility bills and rent receipts can protect tenants from financial liability and provide evidence of payments made.

- Develop a clear and fair allocation formula.

- Provide tenants with regular statements showing their utility usage and costs.

- Be responsive to tenant concerns and disputes.

Examples of Successful Implementations

* A multi-family apartment building in New York City installed submeters for each unit and saw a 15% reduction in utility costs.

A student housing complex in California used an allocation formula based on square footage to divide utility costs among tenants, resulting in fairer billing and reduced disputes.

Table: Key Advantages and Disadvantages of Submetering and Allocation Systems

| Method| Advantages| Disadvantages||—|—|—|| Submetering|

- Fairness

- Conservation

- Cost savings |

- Installation and maintenance costs

- Potential for disputes

- Complexity |

| Allocation|

- Fairness

- Simplicity

- Lower installation costs |

- Potential for disputes

- Inaccuracy

- Complexity |

Choosing the Best System

The best submetering or allocation system for a particular property depends on factors such as:* Number of tenants

- Size and type of property

- Utility usage patterns

- Landlord’s budget

Technology in Submetering and Allocation

Smart meters and data analytics can be used to improve the accuracy and efficiency of submetering and allocation systems. Smart meters can collect real-time data on utility usage, which can be used to create more accurate billing statements and identify areas for conservation.

Data analytics can be used to analyze usage patterns and identify trends, which can help landlords make better decisions about energy management and utility pricing.

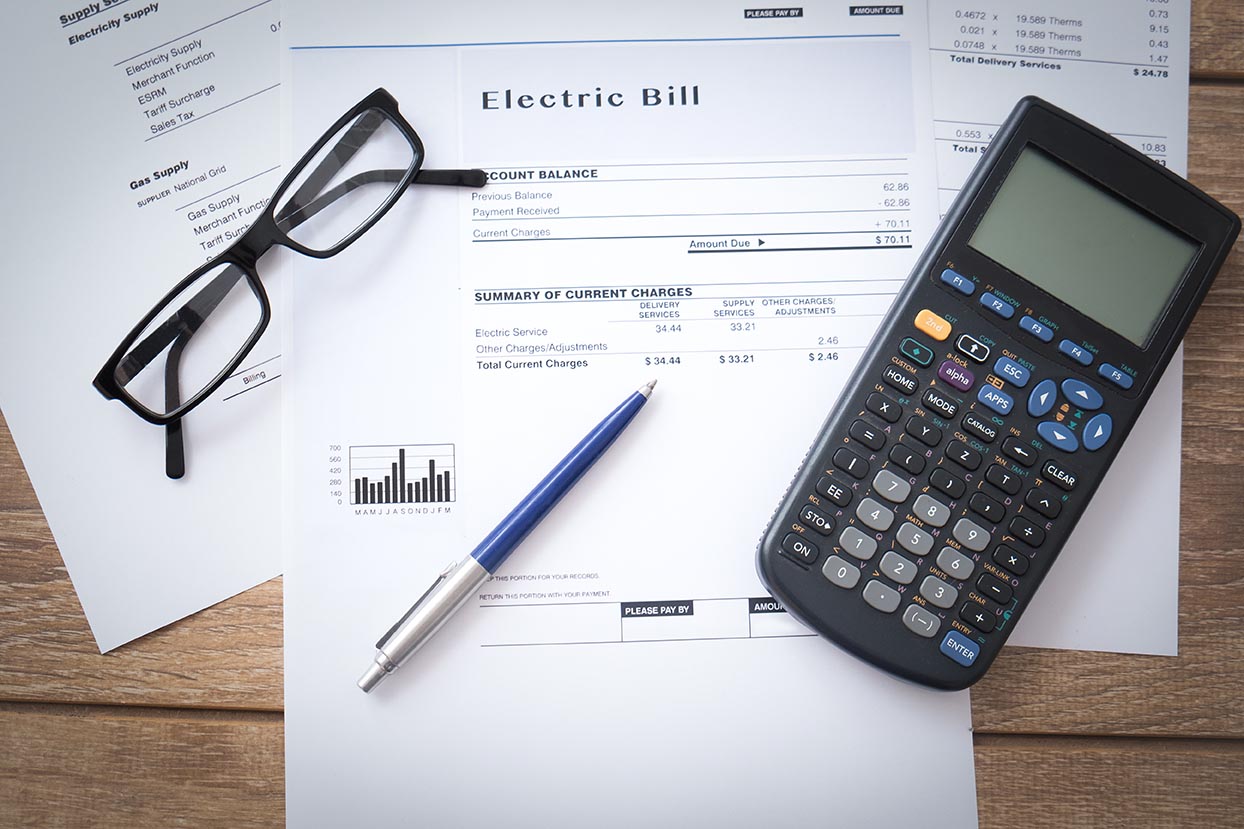

Budgeting and Cost Estimation

Estimating and budgeting for utility costs is essential for both tenants and landlords. Understanding usage patterns, property characteristics, and available government assistance can help optimize expenses and ensure financial stability.

To estimate utility costs, consider the following factors:

Usage and Property Characteristics

- Square footage: Larger properties generally consume more utilities.

- Number of occupants: More occupants lead to increased usage.

- Energy efficiency rating: Properties with higher ratings consume less energy.

Average Utility Costs

The following table provides average utility costs for different property types:

| Property Type | Electricity | Water | Gas |

|---|---|---|---|

| Single-family home | $100-$200/month | $50-$100/month | $50-$150/month |

| Apartment | $50-$150/month | $25-$75/month | $25-$75/month |

| Commercial building | $200-$500/month | $100-$250/month | $100-$250/month |

Budgeting and Management Strategies

- Track expenses: Use a budget to monitor utility consumption and identify areas for savings.

- Reduce consumption: Implement energy-efficient practices, such as turning off lights when leaving a room.

- Negotiate rates: Contact utility providers to inquire about discounts or payment plans.

Sample Budget

Expense Category| Monthly Cost

Electricity | $120

Water | $60

Gas | $75

Total| $255

Government Assistance

Various government programs offer assistance with utility costs, such as:

- Low Income Home Energy Assistance Program (LIHEAP)

- Weatherization Assistance Program (WAP)

Energy Efficiency and Conservation

Energy efficiency in rental properties is of paramount importance for both environmental and financial reasons. It involves practices and technologies aimed at reducing energy consumption without compromising comfort or functionality.

Landlords play a crucial role in promoting energy efficiency by investing in energy-efficient appliances, insulation, and lighting systems. They can also provide tenants with information and incentives to adopt energy-saving practices.

Role of Tenants

- Tenants can contribute to energy conservation by using energy-efficient appliances, turning off lights when leaving a room, and unplugging electronics when not in use.

- They can also report any energy-related issues to the landlord promptly to ensure timely repairs and maintenance.

Energy-Saving Measures

- Energy-efficient appliances:Appliances with Energy Star ratings consume less energy without sacrificing performance.

- Insulation:Proper insulation in walls, ceilings, and floors reduces heat loss in winter and heat gain in summer.

- Energy-efficient lighting:LED and CFL bulbs use significantly less energy than traditional incandescent bulbs.

- Smart thermostats:These devices can be programmed to adjust the temperature based on occupancy and preferences, leading to energy savings.

- Water-saving fixtures:Low-flow toilets, showerheads, and faucets can reduce water consumption and energy used for water heating.

Green Lease Provisions

As environmental awareness grows, green lease provisions are becoming increasingly common in rental agreements. These provisions aim to promote sustainability and reduce the environmental impact of buildings by addressing utility consumption and environmental practices.

Green lease provisions can offer several benefits, including:

- Reduced operating costs for landlords through energy efficiency measures.

- Improved tenant health and well-being through enhanced indoor environmental quality.

- Enhanced building value and marketability.

- Compliance with environmental regulations and sustainability goals.

However, incorporating green lease provisions also presents challenges, such as:

- Increased upfront costs for energy efficiency upgrades.

- Potential conflicts between landlord and tenant interests.

- Lack of standardized green lease language and metrics.

Examples of Green Lease Provisions

Common green lease provisions related to utilities include:

- Energy efficiency standards for appliances and lighting.

- Submetering to track tenant utility consumption.

- Green cleaning and maintenance practices.

- Water conservation measures.

- Waste reduction and recycling programs.

For example, a green lease clause could specify that the landlord is responsible for providing energy-efficient appliances and lighting fixtures, while the tenant is responsible for using energy-efficient practices and paying for their own utility consumption.

Case Studies and Legal Implications

Several successful green lease implementations have demonstrated the benefits of these provisions. For instance, the Empire State Building in New York City reduced its energy consumption by 38% after implementing a green lease program.

Green lease provisions also have legal and regulatory implications. Some jurisdictions have adopted laws and regulations that encourage or require the inclusion of green lease provisions in commercial leases.

Key Benefits and Challenges of Green Lease Provisions

| Benefits | Challenges |

|---|---|

| Reduced operating costs | Increased upfront costs |

| Improved tenant health and well-being | Potential conflicts between landlord and tenant interests |

| Enhanced building value and marketability | Lack of standardized green lease language and metrics |

| Compliance with environmental regulations and sustainability goals |

Drafting and Negotiating Green Lease Provisions

When drafting and negotiating green lease provisions, it is important to consider the following:

- Clearly define the responsibilities of both the landlord and tenant.

- Use specific and measurable performance standards.

- Consider the potential impact on utility costs and building operations.

- Seek legal advice to ensure compliance with applicable laws and regulations.

Role of Technology

Technology can play a significant role in facilitating the implementation of green lease provisions. Smart building technologies, such as energy management systems and submetering devices, can provide real-time data on utility consumption and environmental performance.

Utility Emergencies and Repairs

When utility emergencies or repairs arise, it’s crucial to understand the respective responsibilities of landlords and tenants. Both parties have legal obligations and industry standards to adhere to in such situations.

Landlords are generally responsible for maintaining the property and ensuring that utilities are in good working order. This includes responding promptly to utility-related emergencies, such as gas leaks, water main breaks, or electrical outages.

Landlord Responsibilities

- Respond promptly to utility emergencies and repairs.

- Ensure that utilities are in good working order and meet safety standards.

- Provide reasonable notice to tenants before performing non-emergency repairs.

- Comply with legal requirements and industry standards for utility maintenance and repairs.

Tenant Responsibilities

- Report utility emergencies or repairs to the landlord promptly.

- Allow the landlord access to the property for repairs or maintenance.

- Use utilities responsibly and avoid causing damage or excessive wear and tear.

- Follow safety guidelines when using utilities, such as turning off gas valves in the event of a leak.

In the event of a utility outage, tenants should contact the utility company directly. Landlords are not responsible for outages caused by the utility company or factors beyond their control, such as natural disasters.

It’s important for both landlords and tenants to communicate effectively during utility emergencies or repairs. Open communication and a clear understanding of responsibilities can help ensure that issues are resolved promptly and efficiently.

Landlord-Tenant Disputes: Is Utilities Included In Rent

Utility-related disputes between landlords and tenants can arise for various reasons, such as disagreements over payment responsibilities, excessive usage, or maintenance issues. Understanding the legal process for resolving these disputes and adopting preventive measures can help maintain harmonious landlord-tenant relationships.

Legal Process

Utility disputes typically fall under the jurisdiction of local housing authorities or courts. Tenants who believe their landlord has violated the terms of the lease or applicable laws can file a complaint. The process involves submitting evidence, attending hearings, and potentially seeking legal representation.

Landlords, on the other hand, can initiate eviction proceedings if tenants fail to fulfill their utility obligations.

Prevention and Mitigation

To prevent and mitigate utility-related conflicts, both parties should:

- Clear Lease Agreements:Leases should explicitly Artikel utility responsibilities, including which utilities are included in rent and which are tenant-paid. This clarity reduces the likelihood of misunderstandings.

- Open Communication:Landlords and tenants should maintain open lines of communication to address any concerns or disputes promptly. Regular inspections and discussions can help identify potential issues before they escalate.

- Energy Audits:Landlords can conduct energy audits to identify areas for improvement and reduce utility costs. Tenants can also implement energy-saving measures to minimize their consumption.

Utility Deregulation and Its Impact

Utility deregulation has significantly impacted rental agreements, leading to changes in the way utility costs are allocated between landlords and tenants. It has also led to the emergence of new utility billing models and increased competition in the utility sector, potentially lowering utility costs for tenants.

Role of Third-Party Utility Providers, Is utilities included in rent

Third-party utility providers have emerged as a result of deregulation, offering services such as billing, customer service, and energy efficiency programs. They enter into contracts with both landlords and tenants, providing a range of options for managing utility consumption and costs.

Potential Benefits and Challenges of Utility Deregulation

- Lower utility costs for tenants:Increased competition among utility providers can drive down prices, benefiting tenants.

- Increased competition and innovation:Deregulation fosters competition, encouraging providers to offer innovative products and services.

- Confusion and disputes:The complexity of new billing models and contractual arrangements can lead to confusion and disputes between landlords and tenants.

- Increased costs for landlords:Landlords may face higher costs if they are responsible for maintaining and repairing aging utility infrastructure.

Examples of Utility Deregulation’s Impact

In California, deregulation has led to a competitive energy market, with tenants benefiting from lower electricity prices. In contrast, in Texas, deregulation has resulted in higher electricity costs for some consumers due to market volatility.

Table of Key Findings

| Impact | Key Findings ||—|—|| Utility Cost Allocation | Landlords and tenants may share utility costs differently under deregulation. || Billing Models | New billing models have emerged, such as time-of-use pricing and smart grid technologies. || Competition and Innovation | Increased competition has led to lower utility costs for tenants and innovation in energy efficiency programs.

|| Landlord-Tenant Disputes | Complex billing arrangements can lead to confusion and disputes. || Landlord Costs | Landlords may face increased costs for infrastructure maintenance and repairs. |

Conclusion

Utility deregulation has had a significant impact on rental agreements, bringing both benefits and challenges. Policymakers should consider measures to mitigate potential drawbacks, such as providing clear guidelines for billing and contractual arrangements, and supporting programs that promote energy efficiency and affordability.

Regional Variations

The inclusion of utilities in rent can vary significantly across different regions. This is due to several factors, including climate, infrastructure, and market conditions.

In regions with warm climates, utilities such as air conditioning may be more likely to be included in rent, as they are considered essential for comfortable living. In colder climates, utilities such as heating may be more likely to be included.

The availability of infrastructure can also affect the inclusion of utilities in rent. In areas with well-developed infrastructure, utilities such as water and electricity may be more likely to be included in rent, as they are easily accessible. In rural areas, tenants may be more likely to be responsible for their own utilities, as infrastructure may be less developed.

Market conditions can also play a role in the inclusion of utilities in rent. In competitive rental markets, landlords may be more likely to include utilities in rent in order to attract tenants. In less competitive markets, tenants may be more likely to be responsible for their own utilities.

Examples of Regional Variations

- In California, it is common for landlords to include utilities such as water, electricity, and gas in rent. This is due to the state’s warm climate and well-developed infrastructure.

- In New York City, it is more common for tenants to be responsible for their own utilities. This is due to the city’s high cost of living and competitive rental market.

- In rural areas of the United States, it is more common for tenants to be responsible for their own utilities. This is due to the lack of infrastructure in these areas.

Smart Utility Management

Smart utility management utilizes technology to monitor and control utilities in rental properties. It involves installing smart meters, thermostats, and other devices that collect data on energy consumption and allow for remote management.

Benefits of Smart Utility Management

- Improved energy efficiency:Smart devices track energy usage, allowing landlords and tenants to identify areas for improvement and reduce consumption.

- Reduced costs:By optimizing energy use, smart utility management can lower utility bills and operating expenses for both parties.

- Enhanced comfort:Smart thermostats enable remote temperature control, ensuring tenant comfort and optimizing heating and cooling systems.

Limitations of Smart Utility Management

- Installation costs:Installing smart devices can involve upfront costs, which may need to be shared between the landlord and tenant.

- Privacy concerns:Smart devices collect data on energy usage, which may raise privacy concerns for tenants.

- Reliability:Smart devices rely on internet connectivity, which may be unreliable in certain areas or during power outages.

Legal Resources and Assistance

Tenants facing utility-related issues can seek assistance from various legal resources and organizations. These organizations provide legal advice, representation, and mediation services to help tenants understand their rights and resolve disputes with landlords.

Tenant Advocacy Groups

Tenant advocacy groups are non-profit organizations dedicated to protecting the rights of tenants. They provide legal assistance, education, and support to tenants facing housing issues, including utility disputes. Some notable tenant advocacy groups include:

- National Low Income Housing Coalition (NLIHC)

- National Housing Law Project (NHLP)

- Legal Services Corporation (LSC)

Government Agencies

Government agencies also play a crucial role in protecting tenant rights. Local and state housing authorities enforce fair housing laws and provide assistance to tenants facing utility disputes. Some examples of government agencies that offer utility-related assistance include:

- Department of Housing and Urban Development (HUD)

- Federal Trade Commission (FTC)

- State and local consumer protection agencies

Legal Aid

Tenants facing utility disputes may qualify for legal aid services. Legal aid organizations provide free or low-cost legal assistance to low-income individuals and families. To qualify for legal aid, tenants must meet certain income and eligibility requirements. To apply for legal aid, tenants can contact their local legal aid office or visit the website of the Legal Services Corporation (LSC).

Alternative Support Services

Tenants who do not qualify for legal aid may seek assistance from other support services. These services may include mediation, counseling, and financial assistance. Some examples of alternative support services include:

- Community action agencies

- Non-profit housing counseling agencies

- Faith-based organizations

Common Queries

Who is responsible for paying utility bills in a rental property?

Typically, tenants are responsible for paying utility bills, unless otherwise specified in the lease agreement or by law.

Can a landlord require tenants to pay a flat fee for utilities?

Yes, landlords can require tenants to pay a flat fee for utilities, but the fee must be reasonable and based on the actual cost of providing the utilities.

What are the benefits of including utilities in rent?

Including utilities in rent can simplify budgeting for tenants and reduce the risk of disputes over utility payments.